Whether debt and liabilities could be treated similarly would completely depend on the elements used to calculate the sum of the debts. Liabilities, on the contrary, are better when treated as a numerator for debt ratio with equity as a denominator. When the total debt is more than the total number of assets, it depicts that the company has more liabilities than assets. Thus, this debt-to-asset ratio is expected to be less than 1 for investors to take an interest in investing in it and for creditors to rely on the entity for time repayments and default-free deals.

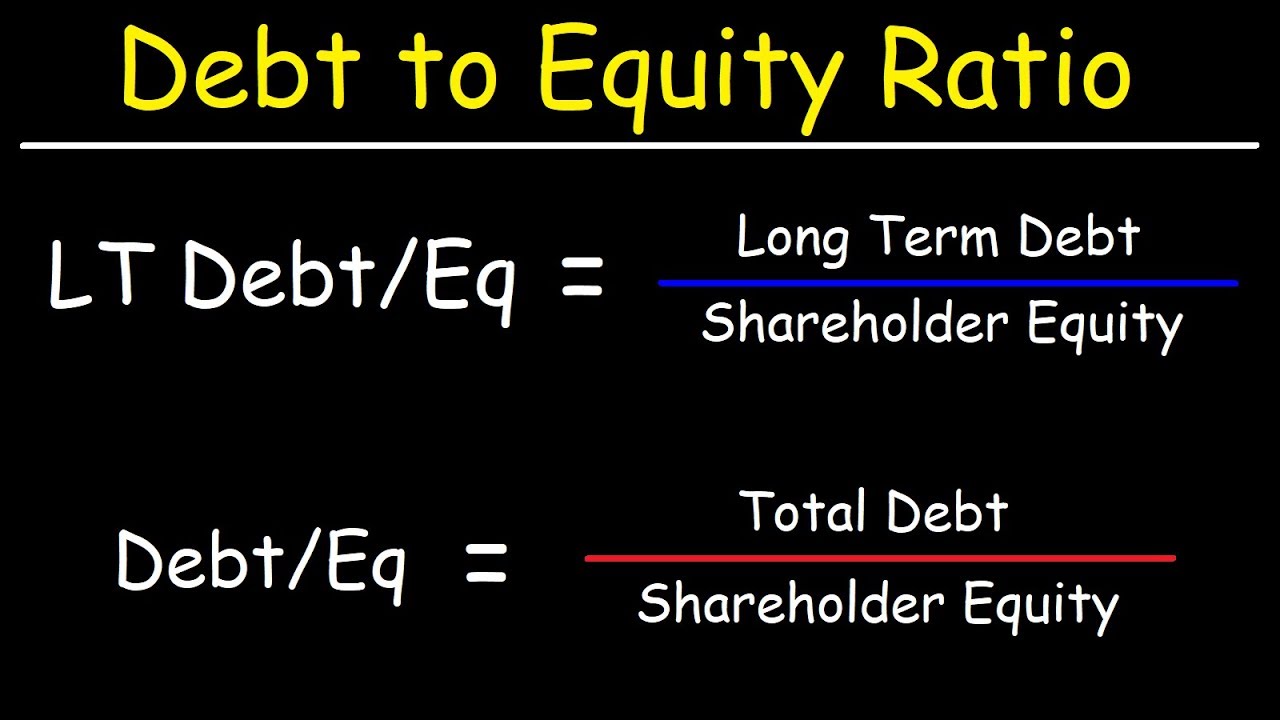

Calculating a Company’s D/E Ratio

The debt to asset ratio is an important indicator as it throws light upon health of the company finances with regard to the risk profile. A lower ratio often expresses conservatism, and high, or a higher, one may indicate high risks or high dependence on debt. The debt to asset ratio, in combination with other financial ratios, can be analyzed to understand best cash back business credit cards of november 2021 and appreciate the overall financial strategy and stability of the company. A ratio above 50% suggests that more than half of the company’s assets are financed by debt, indicating potentially high leverage and financial risk. A debt ratio is a financial metric that indicates the proportion of a company’s debt compared to its total assets.

- Based on the evaluation, they decide whether it would be beneficial for them to invest in it.

- A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets.

- Quick assets are those most liquid current assets that can quickly be converted into cash.

- The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns.

Understanding Debt to Income Ratio for RV Financing: Tips for Success

The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. Let’s look at a few examples from different industries to contextualize the debt ratio. Another key factor that matters in debt ratio evaluation is the perception of stakeholders.

Sign up for latest finance stories

Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. A good D/E ratio of one industry may be a bad ratio in another and vice versa. Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P.

You can access the balance sheets of publicly traded companies on websites like Yahoo Finance, the U.S. Securities and Exchange Commission (SEC), Nasdaq, or the company’s website. In other words, the debt ratio shows how much a company is leveraging or how much of its financing comes from loans and debts. Once we know this ratio, we can use it to determine how likely a company is to become unable to pay off its debts. Tools like Accounting software simplifies tracking the company finances, making it easier to calculate the debt ratio. Business owners use a variety of software to track D/E ratios and other financial metrics.

Other Related Ratios for Specific Uses

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Such comparisons enable stakeholders to make informed decisions about investment or credit opportunities. It gives stakeholders an idea of the balance between the funds provided by creditors and those provided by shareholders.

Too little debt and a company may not be utilizing debt in a healthy way to grow its business. Understanding the debt ratio within a specific context can help analysts and investors determine a good investment from a bad one. Debt ratios must be compared within industries to determine whether a company has a good or bad one. Generally, a mix of equity and debt is good for a company, though too much debt can be a strain. Typically, a debt ratio of 0.4 (40%) or below would be considered better than a debt ratio of 0.6 (60%) or higher.

The debt ratio focuses exclusively on the relationship between total debt and total assets. However, companies might have other significant non-debt liabilities, such as pension obligations or lease commitments. Companies with high debt ratios might be viewed as having higher financial risk, potentially impacting their credit ratings or borrowing costs. Conversely, technology startups might have lower capital needs and, subsequently, lower debt ratios. Comparing a company’s debt ratio with industry benchmarks is crucial to assess its relative financial health. A low debt ratio, typically less than 0.5 or 50%, indicates that a company relies more on equity than on borrowed funds to finance its assets.

Remember that the debt ratio is a starting point, not an end-all in the financial analysis process. If a company has a high level of debt and interest rates rise, the cost of debt might become unsustainable, putting the company at risk despite an acceptably low debt ratio. It’s important investors consider not just the current debt ratio, but how changes in interest rates could affect the company’s financial stability.